Last Week in Deeptech - 18/07/2023

Welcome to the Deepsight weekly newsletter, where we run through last week's notable events in the world of deeptech.

Last Week in News:

OpenAI’s Sam Altman is taking a nuclear-energy startup public (Wall Street Journal)

Apple and Honor to use metal 3D printing to produce next-gen devices (VoxxelMatters)

Explosion occurs during combustion test of JAXA’s Epsilon S Rocket (The Japan News)

Nvidia in talks to be an anchor investor in Arm IPO (Financial Times)

TL;DR - Venture Markets:

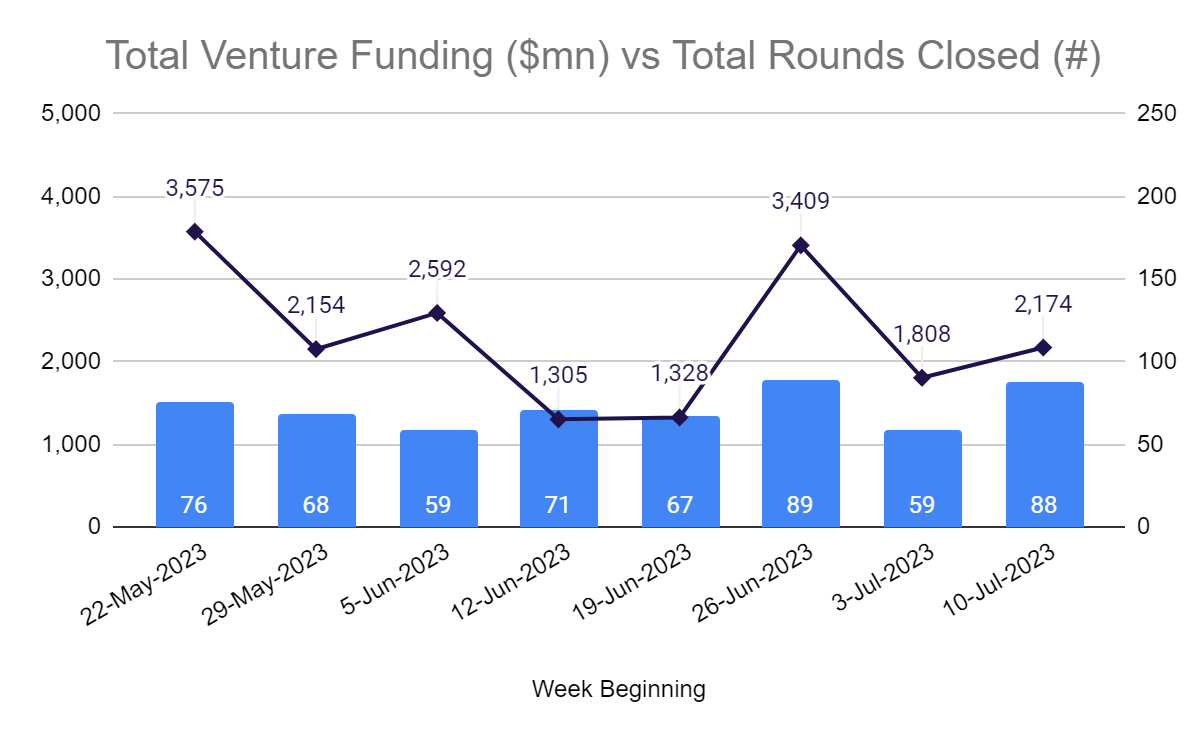

88 deeptech ventures collectively raised $2,174mn from investors.

2 VC funds announced closure, raising a total of $458mn from LPs.

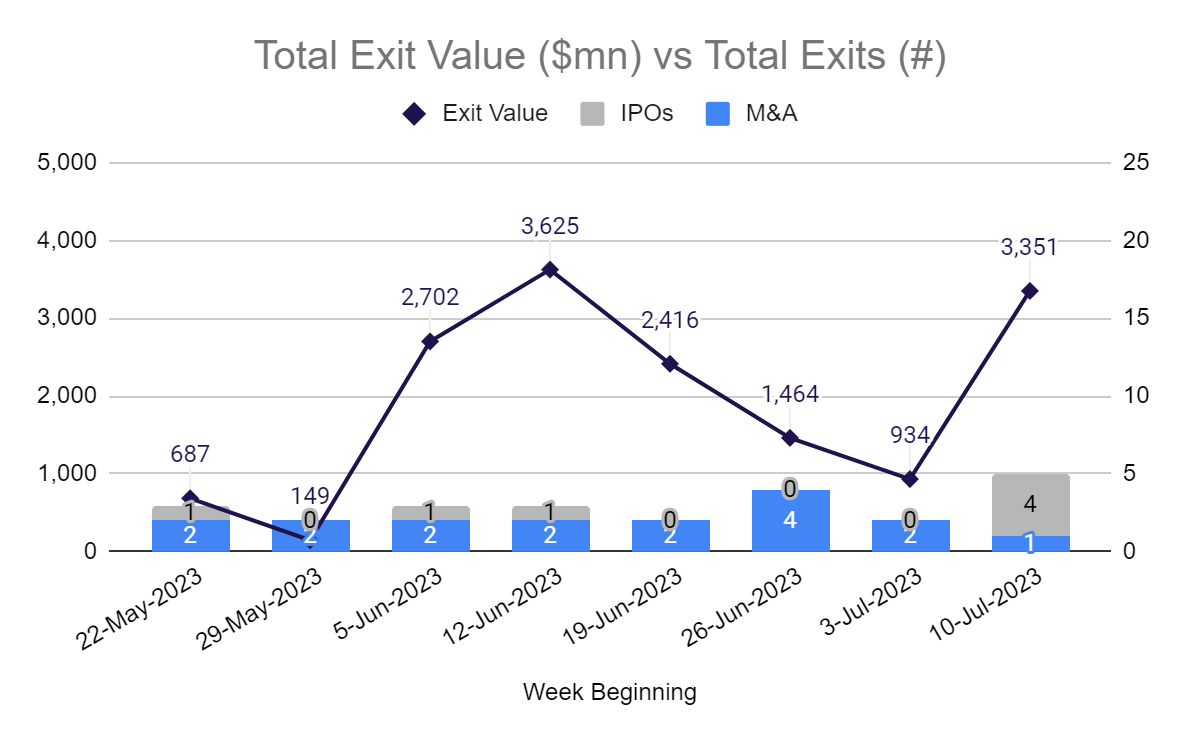

5 companies achieved exits, creating $3,351mn in value for shareholders.

Featured Insights:

Europe’s CVC wave dips as corporates feel the pinch (Sifted)

How do we know how smart AI systems are? (Science)

Tech Breakthroughs & Partnerships:

Indian rocket blasts into space on historic moon mission (The Guardian)

Twelve breaks ground on its plant for sustainable aviation fuel made from CO2 (DCVC)

German project set to be Europe's second-largest green hydrogen facility to reach ‘Final Investment Decision’ (FID) after securing new cash injection (Hydrogen Insight)

QAI Ventures welcomes a new cohort of startups to its accelerator (Quantum Insider)

AWS selects 13 startups to participate in their European Defence Accelerator (AWS)

Metrea announces the first-ever commercial aerial refuelling of US Air Force RC-135 and E-3 aircraft in support of exercise RESOLUTE HUNTER (Metrea)

Anthropic releases Claude 2, its second-gen AI chatbot (Techcrunch)

Our Top 10 Funding Picks:

Wildfire detection startup Pano AI extended its $20mn Series A with another $17mn.

Causaly has raised $60mn in Series B funding led by ICONIQ Growth to catalyze AI-powered preclinical discovery using their category-leading platform.

Recursion announced a new $50mn investment from NVIDIA to accelerate the development of their foundational models for AI-enabled drug discovery.

Venture capital firm Eight Roads led a $30m Series B investment into AI logistics startup Raft (formally known as Vector.ai) to automate elements of the freight industry.

Canada-based CarbonCure Technologies, a leading provider of technologies that introduce captured CO2 into concrete, announced their $80mn Series F funding round.

Bedrock bagged $25.5mn for its seafloor exploration and offshore wind energy robots.

TU/e spin-out and photonic chip foundry SMART Photonics has secured additional funding to the tune of €100mn ($112mn) from strategic industry and financial players.

Tenpoint Therapeutics launched with $70mn in Series A financing to develop their regenerative medicine platform for inherited and age-related conditions.

University of Birmingham spinout Delta g has raised £1.5mn ($2mn) to help develop a commercial underground mapping platform for the construction and utilities sectors.

Crossbow Therapeutics has secured $80mn from investors including Pfizer to advance their novel class of antibody therapies that mimic T-Cell receptors For treating cancer.

See the full list here.

Announced VC Fund Closes:

Sustainable infrastructure investor Spring Lane Capital has announced the final close of their second fund at $290mn, nearly tripling their AUM to $447mn.

BioGeneration Ventures, a leading early-stage VC in European biopharma, announced the closing of BGV V at €150mn ($168mn), its largest fund since launching in 2006.

Champagne-Worthy Exits (M&A & IPOs):

Eli Lilly has entered into a definitive agreement to acquire Versanis Bio, a clinical-stage biopharma company focused on the treatment of cardiometabolic diseases, for $1.9bn.

Apogee Therapeutics, a biotech company advancing differentiated biologics for the treatment of inflammatory and immunology indications, completed an upsized IPO, raising approximately $300mn from investors (before fees) at an $808mn valuation.

Clinical-stage biopharma company Sagimet Biosciences also raised an upsized IPO, raking in $85mn at $16.00 per share, valuing the company at approximately $255mn.

60 Degrees Pharmaceuticals, specialists in developing and marketing medicines for infectious diseases, announced the closing of its IPO at a $29.5mn valuation.

Alpha Healthcare Acquisition III shareholders voted in favor of merging with allogeneic biomaterials developer Carmell Therapeutics in a SPAC deal valued at $328mn.

Policy & Government Initiatives:

With a new export license system for gallium and germanium announced by the Chinese Ministry of Commerce - critical elements in the manufacturing of computer chips, fibre optics and solar cells - its safe to say that “The US-China chip war is still escalating” as The MIT Technology Review has done.

The impact of this announcement extends beyond the US as well, with the EU urgently reaching out to metals producers about filling the supply gap. (read Financial Times coverage here)

In non-China-related news, The US Federal Trade Commission has launched a wide-ranging inquiry into ChatGPT creator OpenAI, seeking to interrogate the company on a wide range of issues from data privacy to the details of how they trained their LLMs. (as noted in Politico)

That’s all for this week!

As always, if you aren’t subscribed already, feel free to sign up below to get notifications straight into your inbox, and to join the growing Deepsight community.

If you have any feedback - or want to see more of something covered in the newsletter - please do contact me via email: dan@deepsight.news.

Thanks for reading!

Dan