Dual-Use Technology - January 2024

Welcome to the Deepsight monthly newsletter, where we run through the most important events in the world of dual-use technology.

Monthly Commentary:

Seeing as I’ll now be covering a more specific focus area within the broader world of deeptech, that being dual-use technology, I thought it would be good to use this first monthly commentary back as an opportunity to outline what I believe dual-use technology actually means.

Dual-use technologies (DUTs for short) are most commonly defined as technologies that have both civilian and military applications. However, this could theoretically mean that a simple pair of socks, worn by both a member of the armed forces on active deployment and a civilian sitting in their living room watching TV, can be classed as a DUT. Not a particularly useful definition.

In a more legislative context, DUTs are normally defined in a categorical sense by the export control rules of a particular country. In the UK for example, there are 10 control categories of ‘dual-use items’, ranging from nuclear materials to aerospace and propulsion systems. However, although not as extreme, we have the same problem as with the socks again. If we take the example of an AI-driven* cybersecurity platform, how it is being used for both civilian and military applications is fundamentally the same i.e., both leverage AI for cybersecurity purposes to protect an organisation’s IT systems. As such, although the categorical approach highlights the ‘areas’ of technology where DUTs can emerge from, it still doesn’t give a robust definition of what a DUT is from first principles.

In this sense, it is probably a good idea to look at the capabilities that the technology enables for the respective civilian and military end-users of the technology. Using the analogy above of an AI-driven cybersecurity platform, for the underlying technology to truly be ‘dual-use’, it should follow that it would have two different cybersecurity uses for civilian and military users i.e., it facilitates two distinguishable capabilities.

Adopting this line of thinking, and utilising the scoping defined previously, a decent litmus test of whether a particular technology is in fact a DUT could therefore be as follows:

“Any technology that facilities two distinguishable capabilities for civilian and military end-users, such that it acts as the technological common ancestor from which both capabilities are derived”

Based on my initial thoughts, research and conversations with people in the field, this quick and heuristical test can serve as a pretty robust first-principles definition of what DUTs actually are.

Anyway, the plan for this section going forward is to offer a running commentary on important events in dual-use technology. But for now, I hope you enjoy the first newsletter back!

*Note: AI itself is not on the UK export control list, but included under the National Security and Investment (NSI) Act - the example given for illustrative purposes is in reference to information security as a DUT.

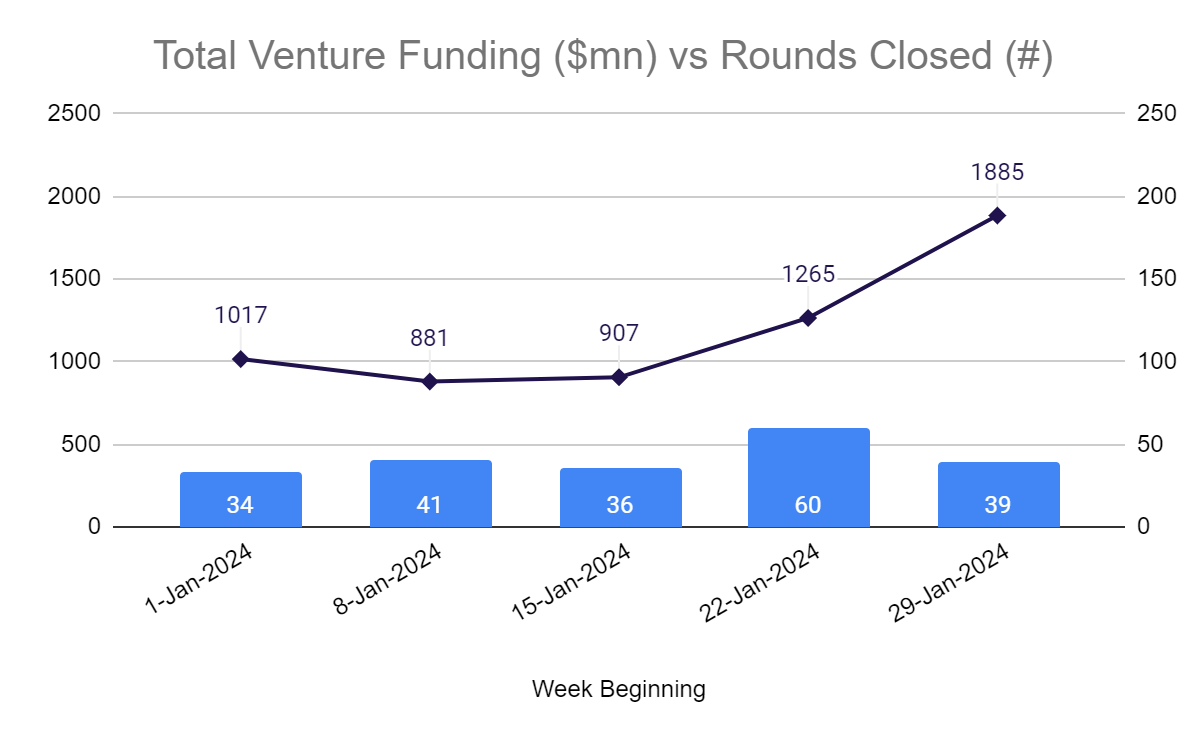

TL-DR - Venture Markets:

1 Declared DUT venture raised $5.7million from investors.

198 Potential DUT ventures raised $4.74billion, giving a D/P ratio of 0.12%.

3 acquisitions involving DUT companies occurred for undisclosed fees.

0 DUT VC funds or government programs announced.

Featured Insights:

The next generation of nuclear reactors is getting more advanced. Here’s how. (MIT Technology Review)

Europe’s top chipmaker Infineon boosts hiring in India and Vietnam (Financial Times)

NASA faces setbacks in push to return humans to moon (Politico)

How can scientists make the most of the public’s trust in them? (Nature)

Our Top 5 Funding Picks:

Cyabra, an Israeli startup which has developed a counter-disinformation platform, has announced the completion of a $5.7million series A extension round led by OurCrowd, adding former US Secretary of State Mike Pompeo to the Board of Directors in the process.

South Korean fabless AI chip startup Rebellions.ai, has closed an oversubscribed series B funding round, raising $124million to develop its third AI chip, called Rebel.

Semiconductor manufacturing equipment company Yiwen Technology has completed over $70million in series D financing led by CICC Jiatai Fund and Haitong New Energy.

Indian aerospace startup Jeh Aerospace has unveiled its new aerospace manufacturing hub in Hyderabad after securing $2.75millon, with VC General Catalyst participating.

Albedo, the first company to offer aerial quality imagery from space using VLEO (very low earth orbit) satellites, has announced a $35million series A-1 financing round.

Champagne-Worthy Exits:

Fairbanks Morse Defense, a portfolio company of Arcline Investment Management, has acquired single-source metalworking supplier Samtan Engineering Corporation.

Bruker Corporation has announced its acquisition of Tornado Spectral Systems to expand its biopharmaceutical process analytical technology (PAT) product portfolio.

Allient, a designer and manufacturer of precision and speciality motion, controls and power products has acquired SNC Manufacturing, a designer and manufacturer of electrical transformers for defence, industrial automation and energy generation.

Key Leadership Movements:

RTX announced Phil Jasper has been appointed president of Raytheon, reporting to President and COO Christopher T. Calio, a 31-year aerospace and defence veteran.

EDGE Group has announced the appointment of Hamad Al Marar as its new Managing Director & CEO, following four years at the helm of the Missiles & Weapons cluster.

True Anomaly, announced the appointment of Frank Di Pentino as its first Chief Strategy Officer, who most recently served as Director of Advanced Concepts, Tactics, and Wargaming at the US Space Force (USSF) Space Security and Defense Program.

Policy Briefing:

To kick-start 2024 with a bang, for the first time since 2020 US and Chinese defence officials met face-to-face at the Pentagon, marking the renewal of what had been a yearly meeting. Politico provides a briefing of the discussions here.

On the other side of the pond, the European Commission wants to make it tougher for investors in rival countries like China to take big stakes in EU startups developing critical dual-use tech by tweaking its foreign direct investment screening law. Sifted cover the announcement here.

Almost simultaneously, an EU official also revealed to Sifted that the first half of 2024 will see an increase in the European Innovation Council’s (EIC) investments in tech startups working in the fields of AI, quantum and semiconductors via its Accelerator programme.